Sustainable Development

Legal Compliance, Anti-Money Laundering amd Counter Terrorism Financing

The compliance system is an important part of internal control and a policy that must be enforced by TCFHC as a financial institution. The system serves an anti-money laundering and counter terrorism financing purpose while deterring other illegal activities. It also prevents key compliance items that endanger the company's operations and cause disruption in the financial market. TCFHC implements relevant organizational frameworks, regulations, and rules to equip itself with abilities to address regulatory or market changes at any time and supervise its compliance practices and status. TCFHC also provides internal training in order to avoid legal risks arising from violation of law and to fulfill a financial institution's role by protecting customers' rights.

Compliance Operations

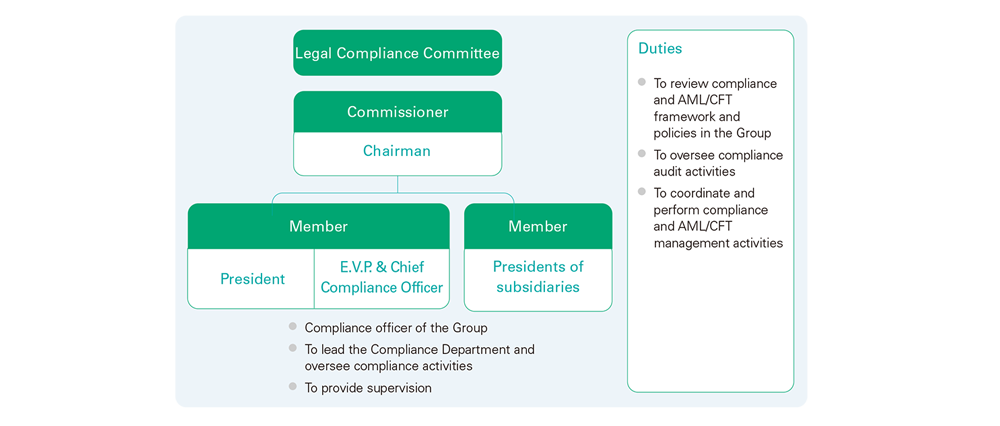

In response to changes in the laws or market conditions, TCFHC has established the “Rules for Implementation of Regulatory Compliance System” according to the “Implementation Rules of Internal Audit and Internal Control System of Financial Holding Companies and Banking Industries”. The “Legal Compliance Committee” is also put in place to devise relevant organizational structures and rules and regulations in order to monitor compliance in the Company.

Regarding compliance audits by the FSC and regulators of affiliated business units, all penalties should be reported immediately to the relevant departments to ensure appropriate response and prevent repeat or further losses. There is a “consistent and real time intercommunications” mechanism set up, which requires each subsidiary report to the TCFHC's Legal Compliance Department the full account of inspections on legal compliance and AML/CFT during the entire course from inception of the inspection to completion of the draft if it happens to have financial competent authority to inspect.

Regarding compliance audits by the FSC and regulators of affiliated business units, all penalties should be reported immediately to the relevant departments to ensure appropriate response and prevent repeat or further losses. There is a “consistent and real time intercommunications” mechanism set up, which requires each subsidiary report to the TCFHC's Legal Compliance Department the full account of inspections on legal compliance and AML/CFT during the entire course from inception of the inspection to completion of the draft if it happens to have financial competent authority to inspect.

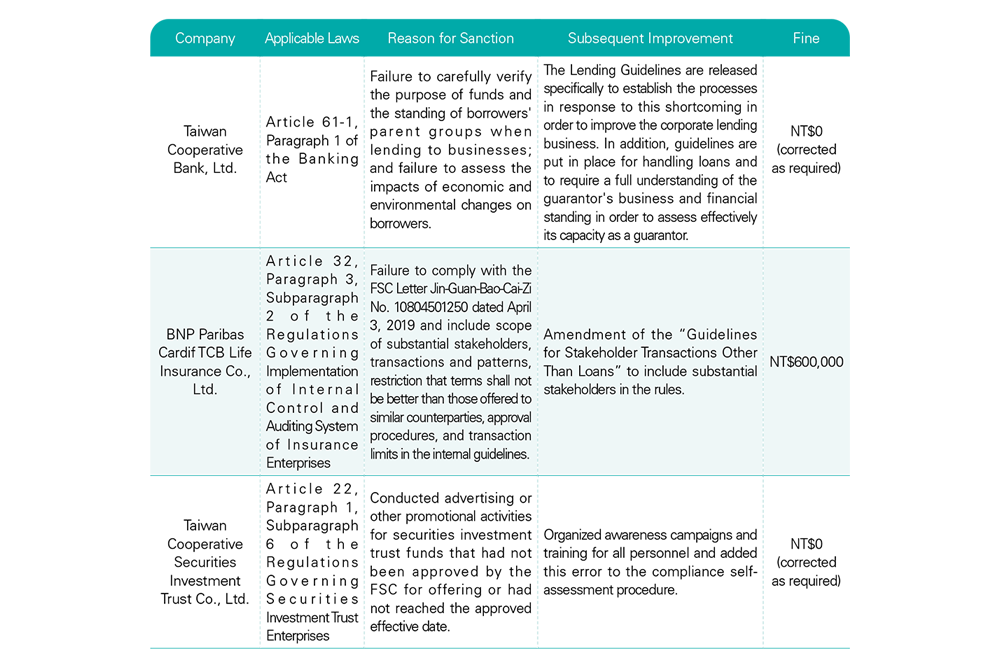

In 2021, TCFHC was not imposed significant fines or non-monetary punishments due to environment, law, or regulations. Yet the remaining punishments as received and related improvements are listed as follows:

Anti-Money Laundering and Counter Terrorism Financing

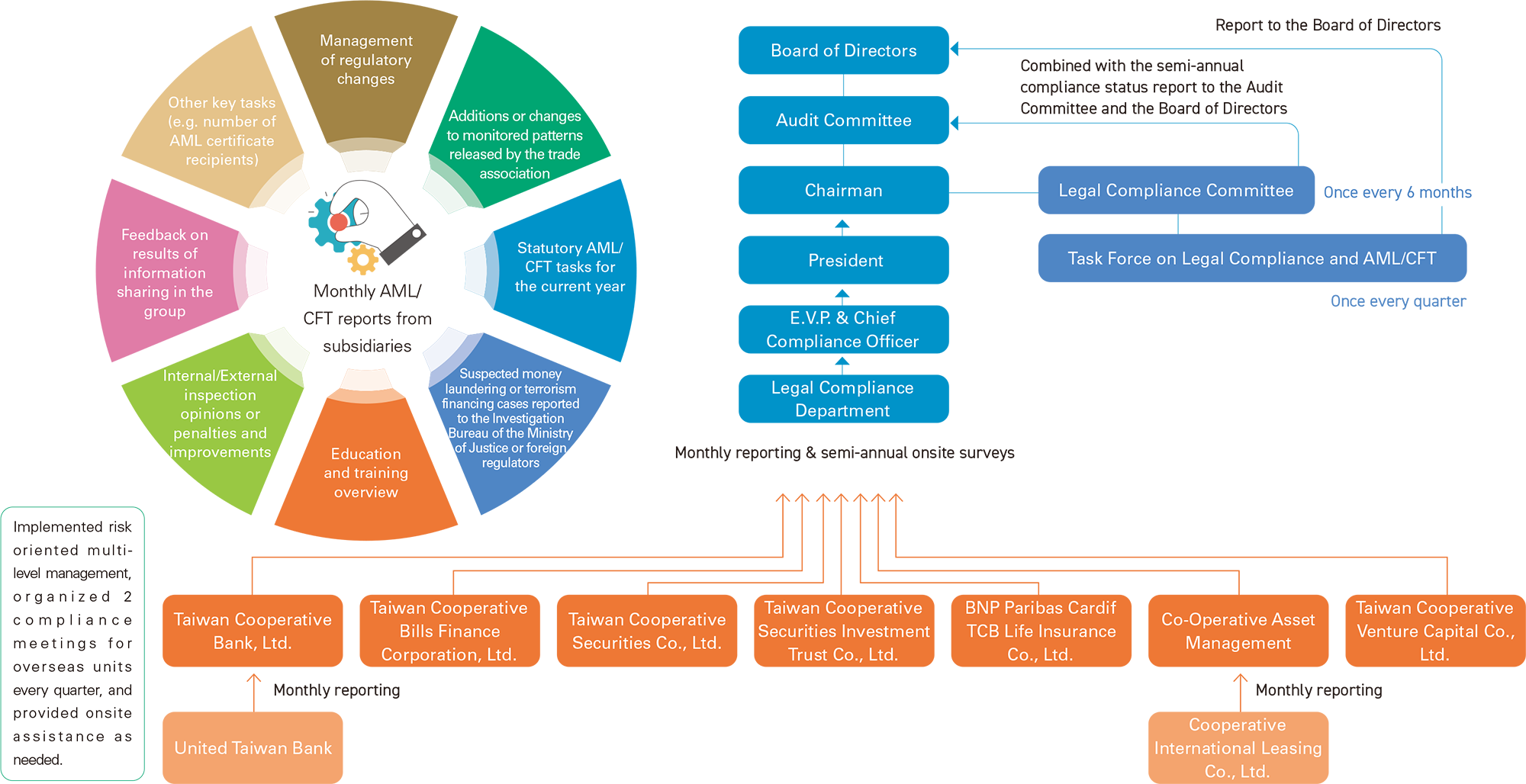

In order to have anti-money laundering and combat of terrorism financing been properly implemented, TCFHC has formulated “TCFHC and Subsidiaries General Anti-Money Laundering and Counter Terrorism Financing Plan” which clearly specifies identification, evaluation, and management principles of money laundering and terrorism financing risks to comply with. In the meantime, the “Task Force on Legal Compliance, Anti-Money Laundering, and Combat of Terrorism Financing” has been set up with the Chief Compliance Officer to assume the convener, responsible for supervising and coordinating for the execution of tasks on compliance and anti-money laundering and combat of terrorism financing undertaken by different subsidiaries. Update on the operation of the task force is submitted to the TCFHC Board of Directors on a quarterly basis.

Strengthen AML/CFT Capabilities

In order to further increase awareness of regulatory framework on anti-money laundering and combat of terrorism financing among employees, relevant educational trainings that TCFHC Group had organized in 2021, had received a total of 73,115 participants with a total training length of 123,471 hours. Additional education trainings on anti-money laundering and combat of terrorism financing for directors/supervisors, senior management, and employees are also held every year with the expectation to raise awareness of legal compliance and professional capability. The Group also encourages employees to obtain the Certified Anti-Money Laundering Specialist (CAMS) credentials and domestic certification for AML/CTF professionals. As of the end of 2021, 5,541 people, or 59.97%, in the Group had obtained such credentials.