Sustainable Development

Protection of Customer Rights

Protection of Customer Rights and Improve Customer Satisfaction

Principles for Treating Customers Fairly

To effectively protect financial consumers' rights and interests, TCB established the “Consumer Protection and Fair Customer Treatment Promotion Committee” in 2019. They are responsible for formulating the policies and strategies concerning principles of treating customers fairly, handling significant consumer disputes and making relevant improvements, and reviewing the progress of promoting fair customer treatment and the evaluation results. TCB, TCS, and BNP TCB Life have all established policies and implementation regulations relating to “Principles for Treating Customers Fairly”. These policies and regulations require all employees to fulfill ethical and fiduciary duties in product and service sales, advertising and soliciting, protection of the right to omplain, and professionalism of salespersons to ensure that consumers are treated fairly and reasonably. All employees are also required to abide by the “Ethical Corporate Management Best Practice Principles”, “Financial Consumer Protection Act”, and “Financial Service Industry Principles for Treating Customers Fairly” to improve customer satisfaction. Moreover, financial consultants are required to sign the “Code of Behavior for Wealth Management Employees” before taking office or performing business.

Meanwhile, in order to grasp the implementation status of the principle of treating customers fairly and improve accordingly, we regularly conduct employee education and training, internal assessments, activate mystery shoppers testing mechanism, and conduct annual credit audits on the financial consultants. In 2021, the training completion rates of TCB, TCS, TCBF, BNP TCB Life and TCSIT all reached 100%, and there were no major deficiencies in the evaluation results.

Meanwhile, in order to grasp the implementation status of the principle of treating customers fairly and improve accordingly, we regularly conduct employee education and training, internal assessments, activate mystery shoppers testing mechanism, and conduct annual credit audits on the financial consultants. In 2021, the training completion rates of TCB, TCS, TCBF, BNP TCB Life and TCSIT all reached 100%, and there were no major deficiencies in the evaluation results.

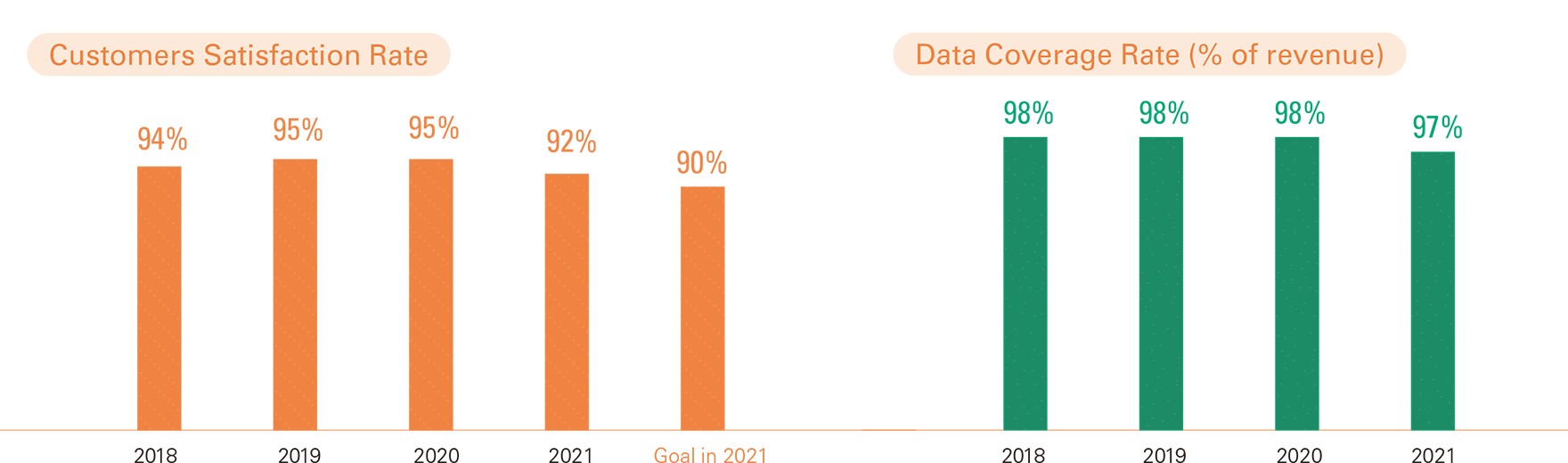

Maintenance of Customer Relations

Having a sound customer relationship is an integral element for stimulating the TCFHC Group to raise its competitiveness. TCB, TCS, and BNP TCB Life engages with the consumers every year to understand their opinions and suggestions on the Group's financial products and services and improve the quality of customer services. TCFHC Group has smooth communication and complaint channels. Consumers can make complaints through dedicated lines and e-mails. After the Group receives customer's complaints, the complaints will be handled according to the customer complaint operational procedures. The process of handling the complaints are based on the regulations of the “Personal Data Protection Act” to protect customers' privacy. The handling process and improvement measures will be reported to the president to improve customer services. In 2021, TCFHC Group received a total of 291 customer complaints. TCS has 1 unsettled case, and the remaining 290 cases have been handled and are closed. In addition, TCFHC Group did not receive any complaints about invasion of customer privacy or loss of customer information, and there were no leakage of customer information in 2021.

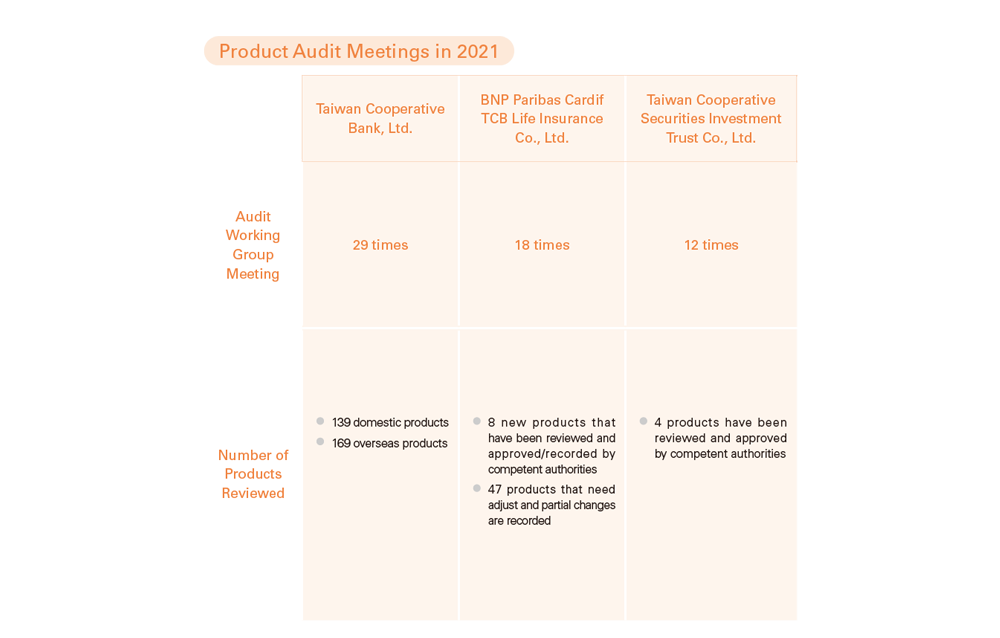

Procedures of Product Review and Sales

All of the financial products introduced by the TCFHC Group meet the regulatory requirements set by each of the subsidiary's industries. The products have also gone through internal reviews to make sure that they do not contain inappropriate content, untruthful statements, misleading information, or violation of relevant regulations and self-regulatory rules. If products require prior approval from competent authority before putting up for sale, such products have to go through further post-sale review on the content of the product subject to actual sales performance, consumers' reactions and opinions, and changes of relevant regulations, so as to ensure that all the financial products meet both the regulations and the needs of consumers.