Sustainable Development

Digital Finance

TCFHC Group utilizes the developmental trend of digital technology plus commercial innovation and values user design and customer experience. The Group creates various customer-centric financial services to create more consumer friendly financial products so as to raise service efficiency, accessibility, utility, and quality and achieve the maximum financial service benefits of digital applications.

Innovative Digital Finance

The TCFHC Group has been actively promoting innovative digital finance in response to the development of FinTech and the internet-only banking trends. Our efforts include optimizing customer experience through data driven decisions and using big data analysis, robotic process automation (RPA), customer feedback information along with artificial intelligence technology to link automated procedures. Our efforts aim to provide comprehensive digital financial services and make financial products and services more approachable in the real life.

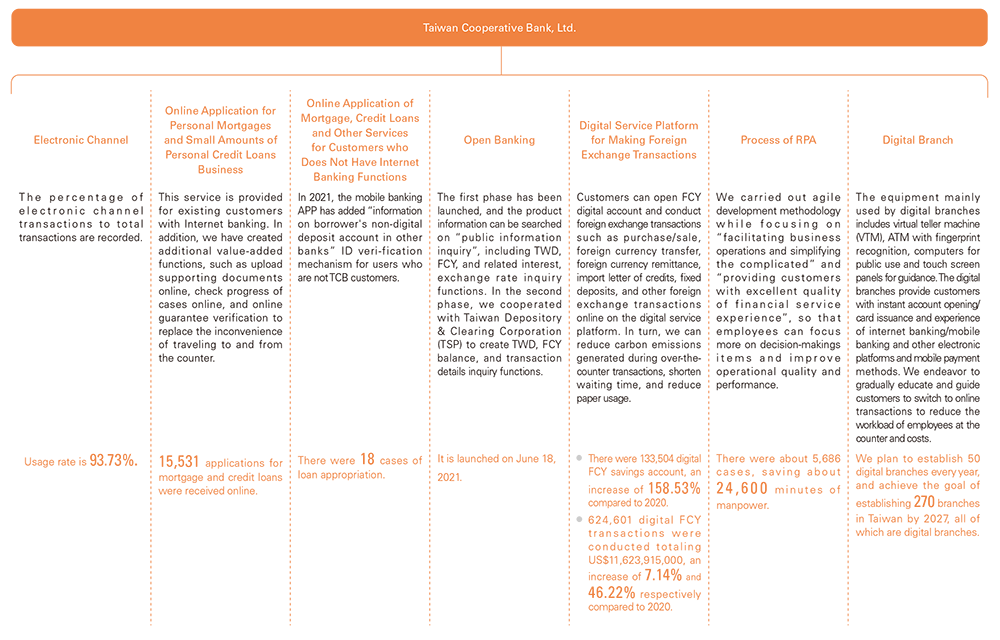

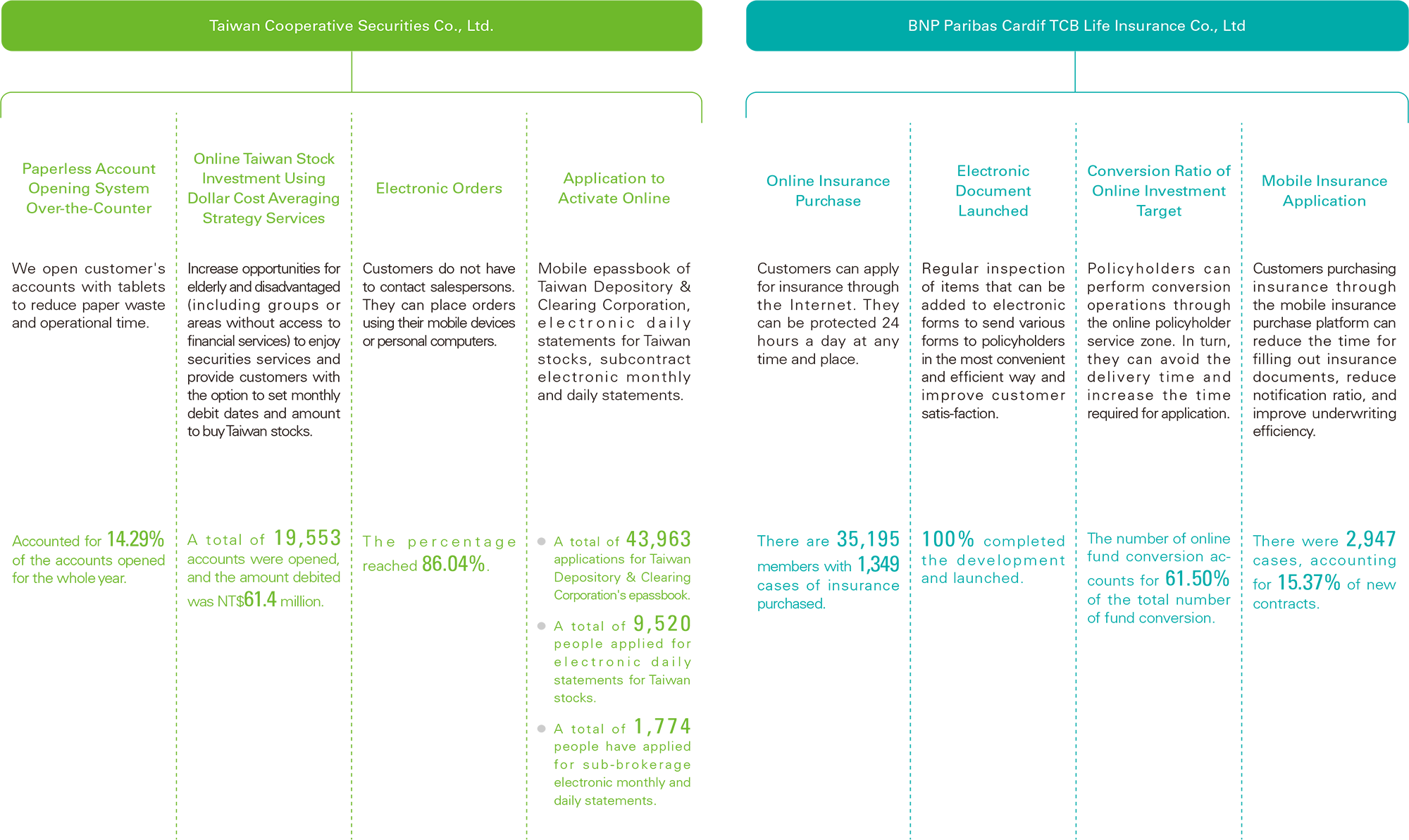

Achievements of TCFHC Group in Promoting Digital Financial Services in 2021

Mobile Banking and Mobile Payment

In support of the Executive Yuan's policy of making mobile payment universal, TCB has worked to strengthen service features and interfaces of mobile and online banking to improve the convenience of customers using mobile banking and mobile payment. In 2021, the total number of mobile banking account reached 1.42 million.

In order to strengthen the adhesiveness with customers, the TCFHC Group has specially launched the “TCB Golden Coin” in 2020. It is a bonus point collection platform that enables customers to gain certain number of points after completing designated events held by TCB, TCS, or BNP TCB Life. These points can be used in exchange of gift coupons for everyday life, entertainment, gourmet, and beverages offered by an array of well-known chained stores. Customers can enjoy multiple discounts on fees such as credit card fees or ATM inter-bank handling fees. Interactive games are used to provide bonus points and lottery draws, which not only create topics but also improve customer satisfaction.

In order to strengthen the adhesiveness with customers, the TCFHC Group has specially launched the “TCB Golden Coin” in 2020. It is a bonus point collection platform that enables customers to gain certain number of points after completing designated events held by TCB, TCS, or BNP TCB Life. These points can be used in exchange of gift coupons for everyday life, entertainment, gourmet, and beverages offered by an array of well-known chained stores. Customers can enjoy multiple discounts on fees such as credit card fees or ATM inter-bank handling fees. Interactive games are used to provide bonus points and lottery draws, which not only create topics but also improve customer satisfaction.

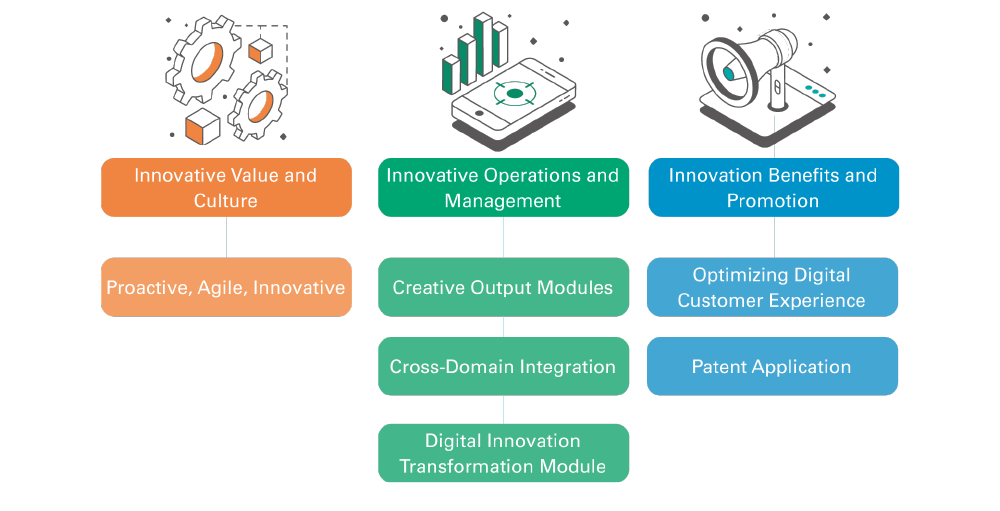

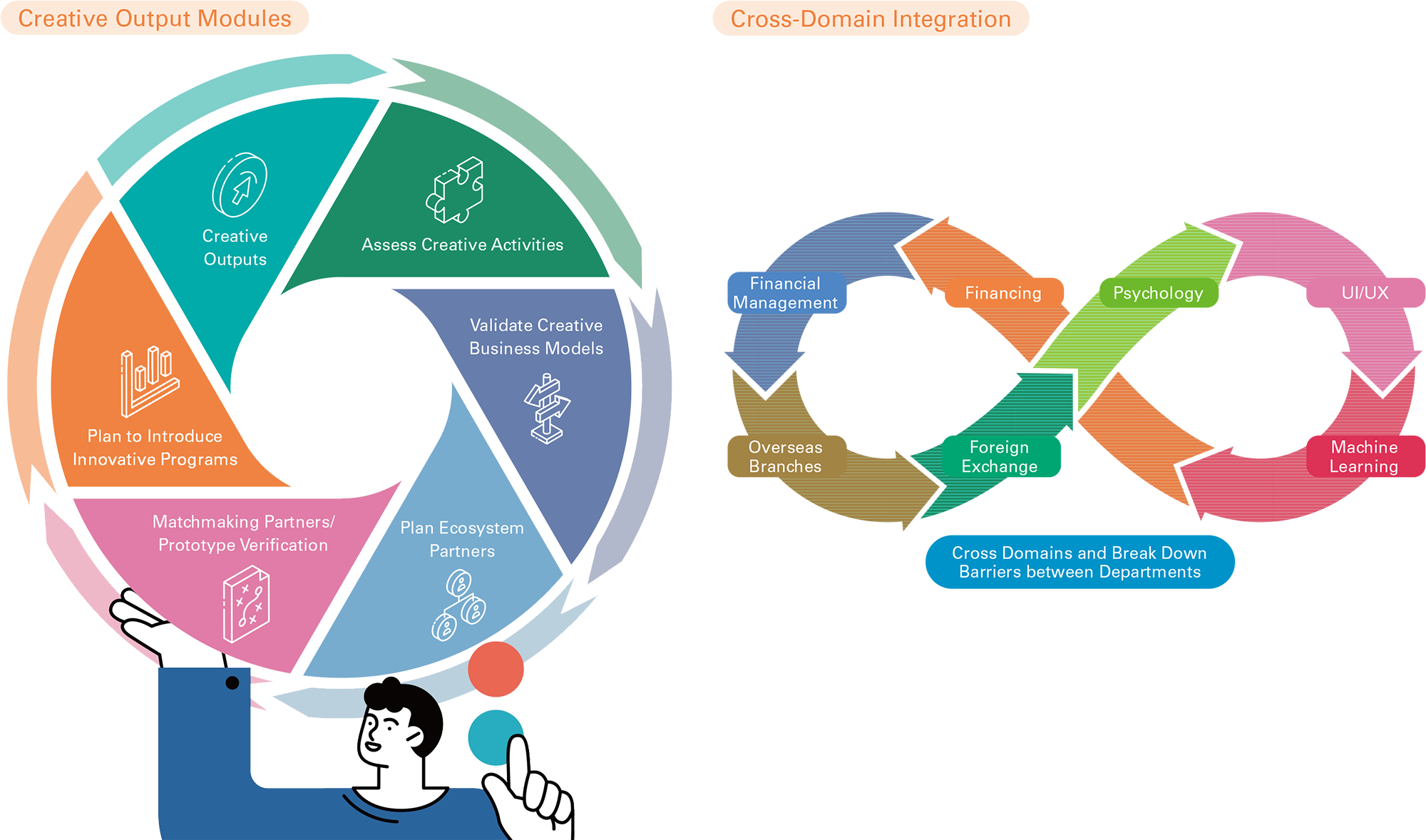

TCB CoLAB

In order to implement talent development and accelerate the promotion of digital innovation, TCB officially established an innovation lab (CoLAB) in November 2019. The inertial business model has been overcome through agile cross-departmental collaboration to achieve creative outputs and expand possible financial service applications in response to market trends and business needs.

Innovative Value and Culture

-

Proactive, Agile, Innovative

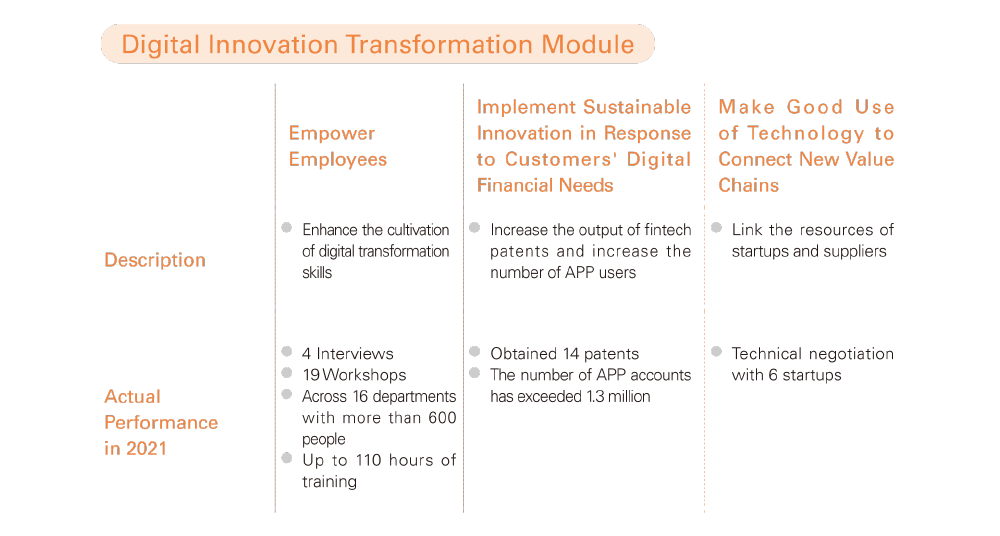

The corporate philosophy of “Proactive. Agile. Innovative”. has become CoLAB's core competencies. It has established an operation module that drives digital innovation transformation, hoping to continue nurturing the growth of digital innovation.

Innovative Operations and Management

Innovation Benefits and Promotion

-

Optimizing Digital Customer Experience

In the post-epidemic era, consumers have gradually become accustomed to using digital equipment in their daily lives. They are paying more and more attention to health and safety issues, and customers' consumption decisions and purchasing behaviors have also begun to change.

TCB's digital customer experience guide created a shared spirit of creation and design and increased cross-team coordination running from online to offline. TCB provides a consistent digital customer experience and promises to continue to dedicate itself to customer care and wellbeing, from identifying digital channel contact points to drawing journey maps for customers. TCB conducted target customer group analysis and digital experience inspection and designed 4 major digital customer experience guidelines, which are “TCB Family”, “Charging Together”, “Creating Together”, “Traveling Together” and 12 executable items for digital customer experience. TCB endeavors to provide better services in the future and achieve the concept of sustainable business.

-

Patent Application

The creative output workshop proposed 5 business ideas, such as physical branch transformation, fundraising trusts, digital investment, and using digital accounts and APPs to apply for a loan. It has obtained 14 patents. In the follow-up, loan application using apps and digital accounts will be verified. They will be launched in February and March 2022, respectively.

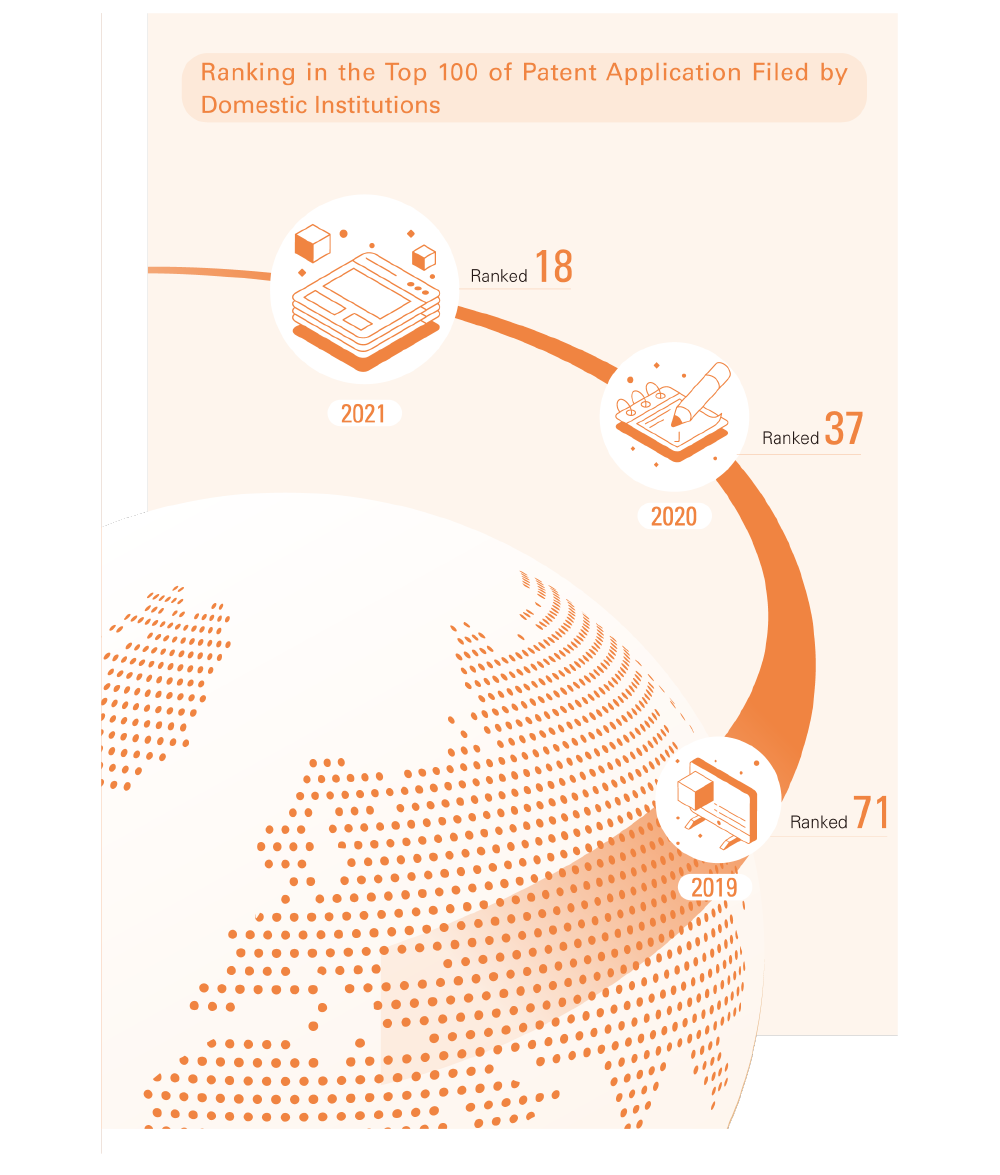

Patent R&D and Management

In response to the Financial Supervisory Commission's “Corporate Governance 3.0 - Blueprint for Sustainable Development” and that the financial industry should value the establishment of intellectual property management systems, TCFHC Group has actively promoted financial innovation. In 2020, among government-funded banks, TCB took the lead and completed the first on-site review of domestic intellectual property management regulations. In 2021, it was notified by the Institute for Information Industry that it passed the TIPS (A-level) verification review, which actively demonstrated TCB's diligence in investing and implementing intellectual property management.

In 2021, TCB continued to implement “Provision of Incentives for Patent Application” and encouraged employees to develop patents. TCB continued to hold “Seminars on Fintech Patent” to develop employees' concept of intellectual property protection and familiarize themselves with the important information on FinTech patent applications. TCB has obtained a variety of invention patents in 2021, which are not just certificates issued by Intellectual Property Office, Ministry of Economic Affairs, but have already been actually utilized in banking operations, including credit facility and loan release, debt management, foreign exchange, business and marketing, anti-money laundering, and electronic finance. It has improved operational efficiency and reduced operational risks.

In 2021, TCB continued to implement “Provision of Incentives for Patent Application” and encouraged employees to develop patents. TCB continued to hold “Seminars on Fintech Patent” to develop employees' concept of intellectual property protection and familiarize themselves with the important information on FinTech patent applications. TCB has obtained a variety of invention patents in 2021, which are not just certificates issued by Intellectual Property Office, Ministry of Economic Affairs, but have already been actually utilized in banking operations, including credit facility and loan release, debt management, foreign exchange, business and marketing, anti-money laundering, and electronic finance. It has improved operational efficiency and reduced operational risks.

- Number of FinTech Patents that Have Been Approved or Are Under Review by TCB in 2021

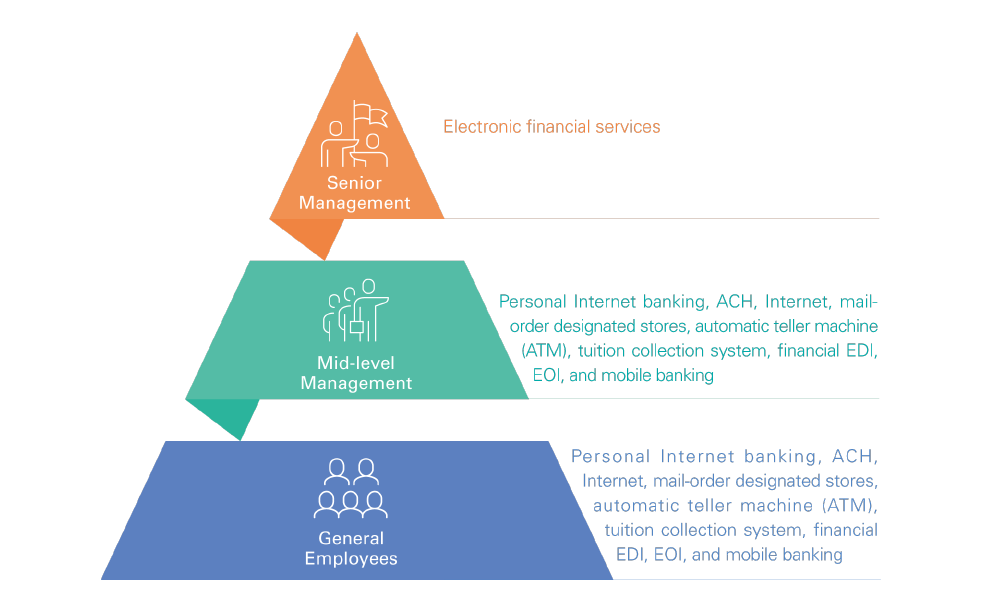

Cultivation of FinTech Talent

In order to enable employees keeping abreast of the latest trend of financial technology and strengthening digital skill so as to grow into digital financial specialist with forward looking vision and beyond-the-boundary thinking, TCB has engaged in collaboration with such academic institutes as National Chengchi University and National Tsing Hua University, established CoLAB to develop seed members, and continuously worked with external consultants to nurture and develop staff with the capabilities of information analysis, technological innovation, or digital marketing through workshops or specialized classes that focus on financial technologies such as blockchains, artificial intelligence, big data, robotic wealth management, and internet of things (IoTs).