Sustainable Development

Financial Inclusion

With humanity and pursuing social well beings as the core value, the TCFHC Group has not just rolled out a variety of financial products and services with inclusive nature but has also wielded influence in the financial industry to endeavor to make people with different backgrounds all entitled to fair and reasonable financial services and resources, so as to implement inclusive finance.

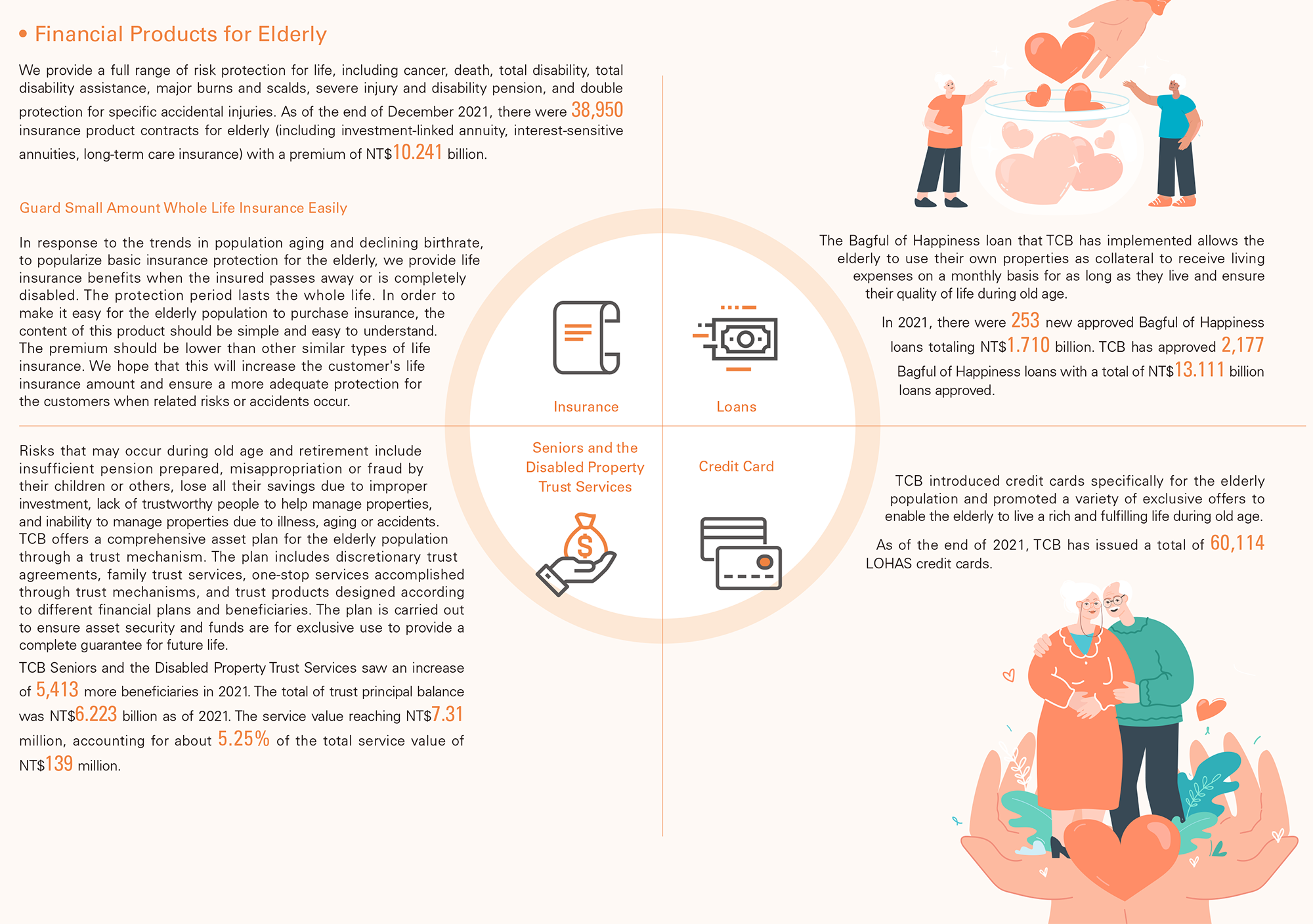

Promoting Urban Renewal

In order to support community development and make living environment safer and more secured, the TCFHC Group has set up “Urban Renewal and Time-worn Buildings Reconstruction Task Force” and launched “Advance Payment for Urban Renewal and Time-worn Buildings Reconstruction” with real estate trust, construction fund trust, and financing plan. Integrated services are provided through partnering with United Real Estate Management Co. Ltd. to assist urban project integrators in acquiring working capital, construction audit, and management of contract enforcement and provide customers with one-stop innovative financial services. As of the end of 2021, the total number of TCB urban renewal and time-worn building reconstruction financing projects being undertaken was 136 totaling NT$81.993 billion.

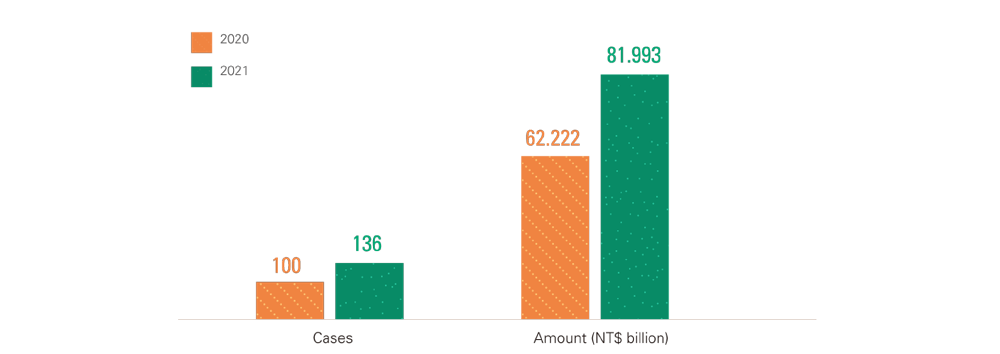

Debt Negotiation

In order to reduce family and social problems and help people to regain confidence and normal living pace they used to have, the TCFHC Group has provided a number of solutions to assist consumers in clearing their debts, including debt negotiation or enforcing the agreement reached in pre-negotiation, re-negotiated debt repayment scheme, or the debtors who failed to reach pre-negotiation agreement could request revival, clearance, or pre-mediation to the court. We endeavor to provide measures that could help mitigate the economic burden of debtors and repay their debts.

For the financially disadvantaged who have difficulties repaying their unsecured debts for 3 months or longer, such as low-income borrowers, borrowers with major illness, moderately disabled borrowers, victims of major natural disasters, and borrowers who have been involuntarily unemployed for 3 months or longer, TCB also offers unsecured debt extension for financially disadvantaged borrowers to help them to settle down and successfully repay their debts.

For the financially disadvantaged who have difficulties repaying their unsecured debts for 3 months or longer, such as low-income borrowers, borrowers with major illness, moderately disabled borrowers, victims of major natural disasters, and borrowers who have been involuntarily unemployed for 3 months or longer, TCB also offers unsecured debt extension for financially disadvantaged borrowers to help them to settle down and successfully repay their debts.

Create a Friendly Financial Environment

A Barrier-Free Friendly Service Environment

270 branches across Taiwan have all had different types of barrier-free facilities or measures in places, including a barrier-free slope for enabling physically or mentally impaired people or other disadvantaged to enter, tactile floor tiles and service bell, barrier-free service counter and ATM, and designated service staffs to assist with financial businesses. As of the end of 2021, TCB had installed 1,119 ATMs for the physically and 9 ATMs for visually impaired. In order to take care of areas with low population density or economically disadvantaged areas, TCB has set up 19 business units and installed 72 ATMs. TCB is providing areas with population density not exceeding 300 people per square kilometer or counties and cities in the bottom 1/3 of economic and employability rankings the same services as other areas.

Friendly Financial Service Zone

- TCB Internet banking:

In order to provide better and more convenient online financial services for people with disabilities, the official website of TCB, personal internet banking, Internet ATMs, and eATMs with simple functions have all obtained the National Communications Commission (NCC) Website Accessibility Guideline Version 2.0 with conformance level AA. It provides the visually impaired and other people functions and interfaces that are easier to operate and can enjoy interbank ATM withdrawal fee discounts 3 times a month. In addition, credit card verification, card issuance, reporting of lost credit cards, and other services can also be handled through various channels such as Internet banking and mobile banking. - TCS official website:

We create a friendly and convenient investment environment for people with disabilities, and strive to provide them with accessible financial services. Various online financial services can eliminate the inconvenience of visiting the counter, save time, and provide professional and complete electronic transaction services 24 hours a day.

Building a Bilingual Financial Service Environment

TCB has established 51 bilingual service branches by the end of 2021. We provide exclusive English service counters, document forms commonly used by foreigners, bilingual signs and ticket dispensers in the business lobby, and multi-language translation machines are equipped to serve customers from non-native English-speaking countries as well. In addition, the branches in Nanjing East Road, Yuanshan, Zhongli, Taichung, and Kaohsiung where Japanese tourists frequently visit have added Japanese language services to enable foreign tourists to enjoy warm and friendly financial services.

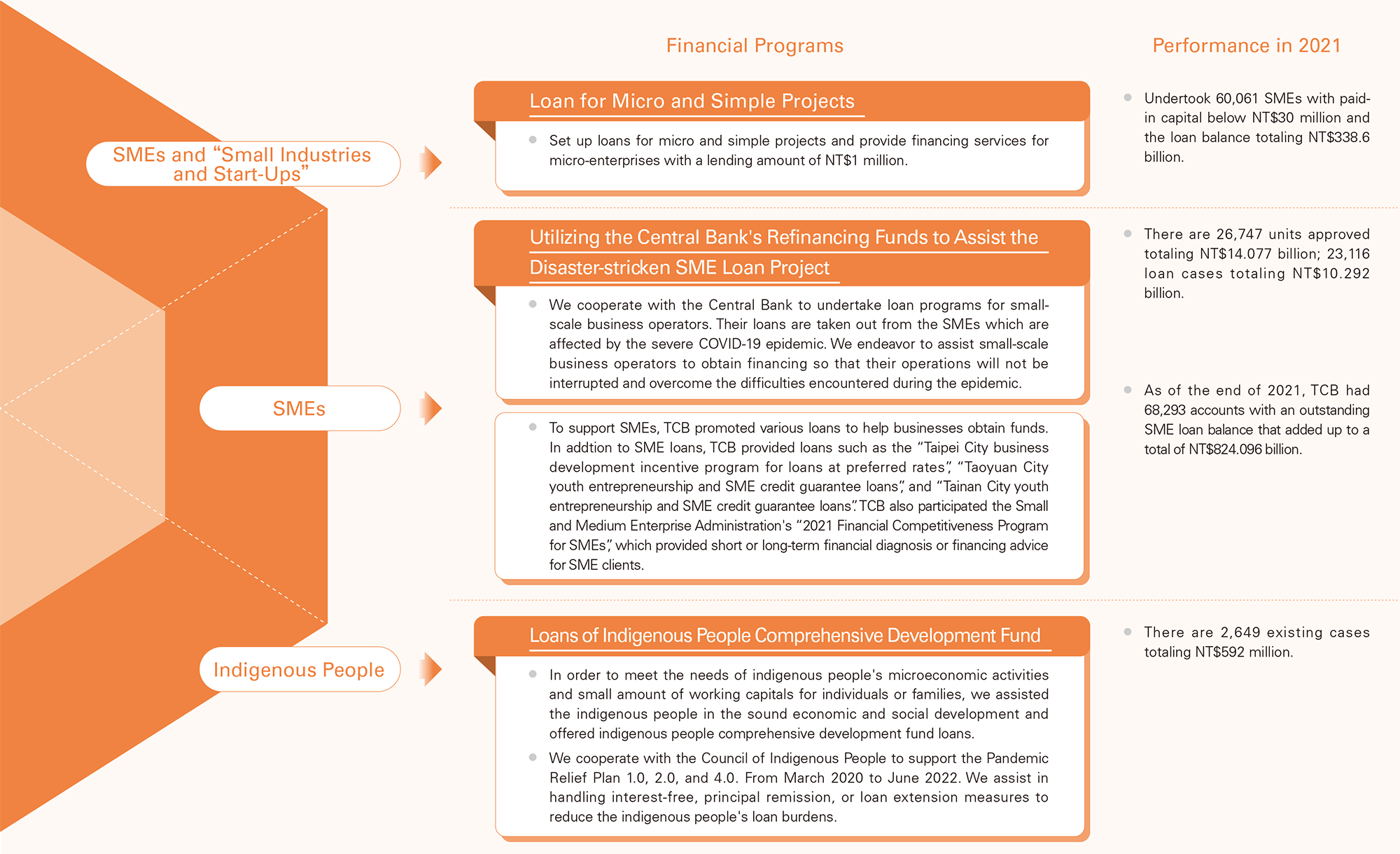

Cultivating the Financial Power of Diverse Groups

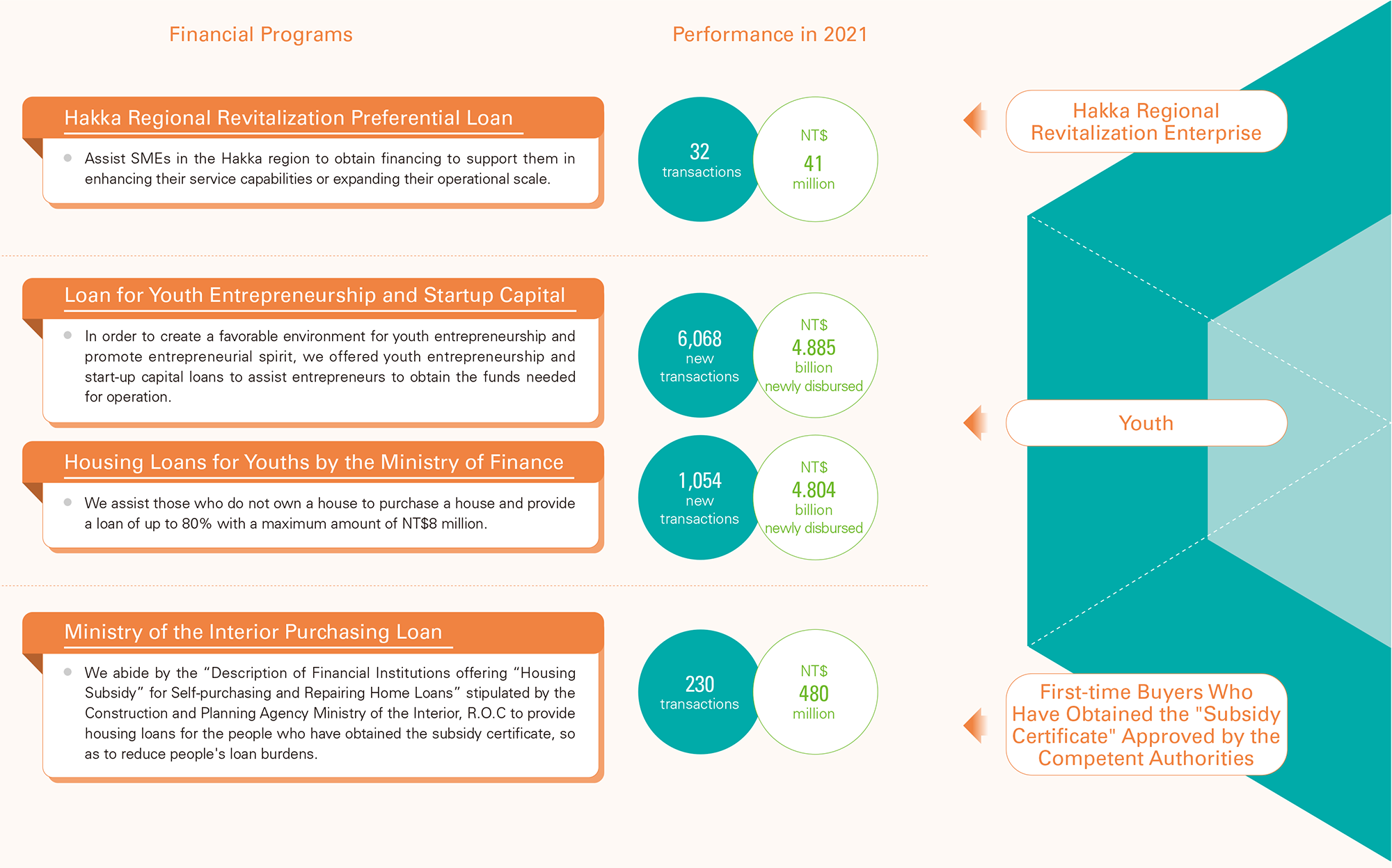

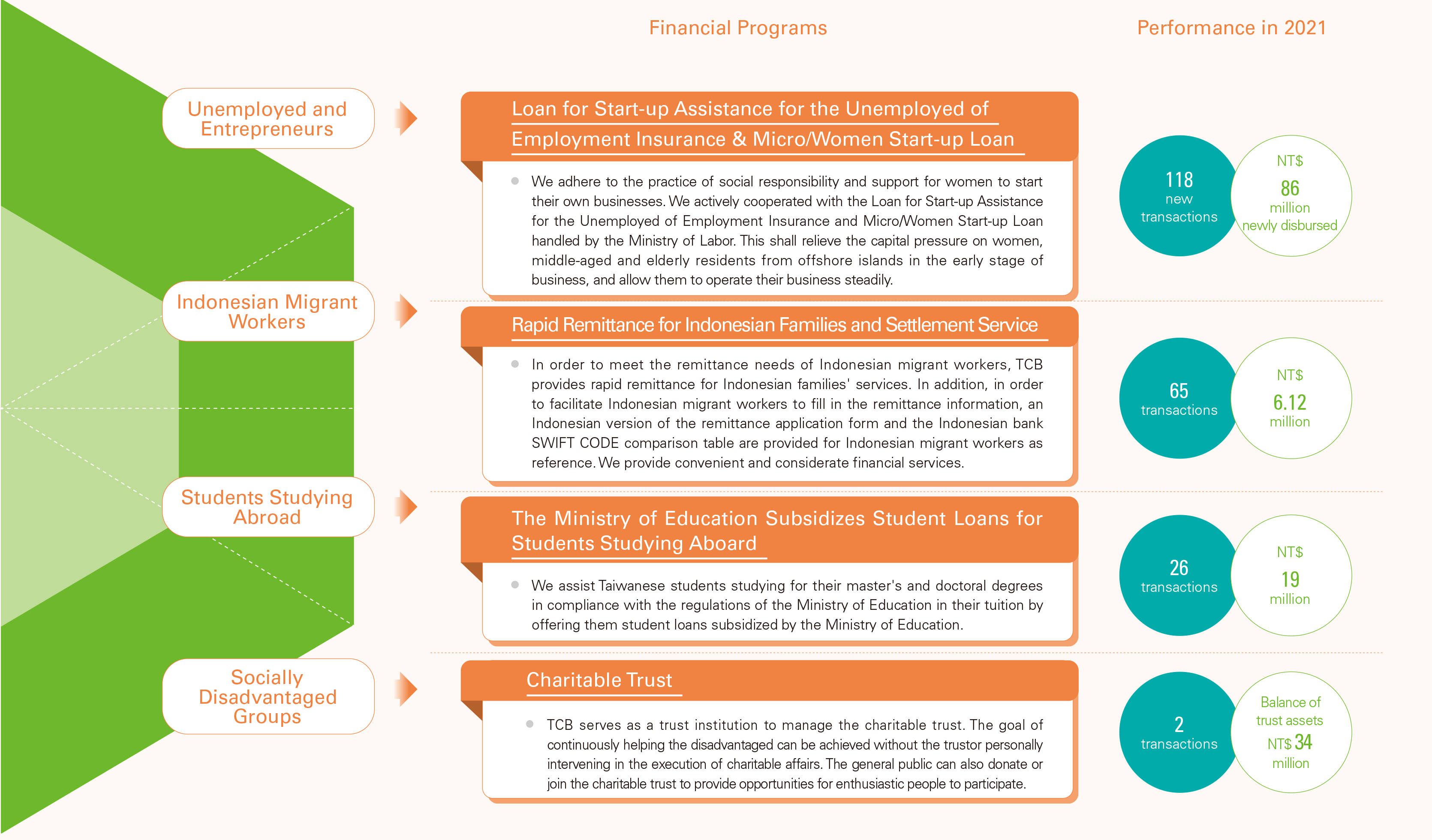

In order to promote economic and social development, TCFHC Group integrated resources to provide diversified financial programs to meet the different needs of customers, hoping to achieve common good in the society through finance.

Of different project loans for stimulating the development of small enterprise and local community that TCB has underwritten, the ones with the amount exceeding NT$5 billion are COVID-19 pandemic relief loan (NT$195.702 billion), urban renewal project loan (NT$16.964 billion), and agricultural and fishery project loan (NT$17.474 billion). The total amount of the 1,371 cases of overdue loan accounted for 0.2% of the total relevant project loans earmarked for stimulating the development of small enterprise and local community.

Of different project loans for stimulating the development of small enterprise and local community that TCB has underwritten, the ones with the amount exceeding NT$5 billion are COVID-19 pandemic relief loan (NT$195.702 billion), urban renewal project loan (NT$16.964 billion), and agricultural and fishery project loan (NT$17.474 billion). The total amount of the 1,371 cases of overdue loan accounted for 0.2% of the total relevant project loans earmarked for stimulating the development of small enterprise and local community.

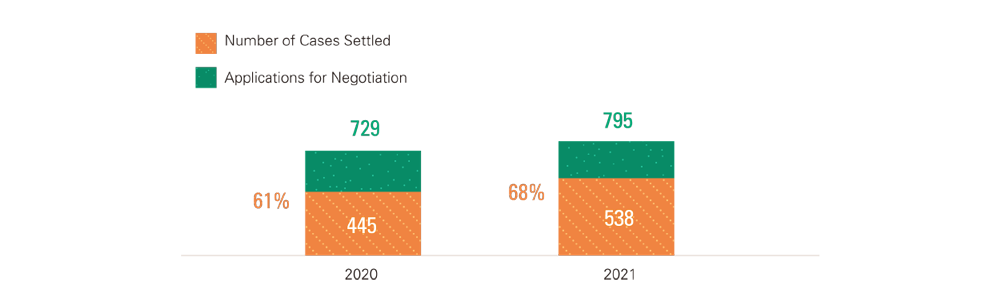

Guarding LOHAS and Elder Care

In support of the government's efforts in building a nationwide long-term care system as well as an environment for development of healthcare industry in context of aging society, the TCFHC Group has continuously integrated different resources to offer a variety of innovative and inclusive financial products and services to the elderly, with an aim of becoming the number 1 brand in LOHAS and elder care so as to leverage its influence as a member of financial industry.

- Talent Cultivation for Products for Elderly

In 2020, TCB has partnered with Taiwan Association of Family Caregivers to launch “Seed Staff of Long-Term Care” training program by contributing its core competitiveness of 270 branches service network to create a warm and compressive product and long-term care services interlinked network to support customers at all aspects and tap into social resources to solve difficulties. In addition, TCB has actively responded to the government trust 2.0 promotion plan and cultivated “Eldercare Financial Planning Consultants” in 2021. TCB is the first bank to have more than 100 Eldercare Financial Planning Consultants dedicated to helping customers with trust planning and relevant consultant service regarding happy living and secure caring. - Four-in-One Trust for Building Healthy Co-Sharing Residence

In order to take care of the elderly in all aspects as well as stimulate the development of the long-term care industry, TCB is the first state-owned bank to launch preferential projects for long-term care institutions. It has established “Rules of Loan for Long-term Care Institutions” and “Long-term Care Institutions Improving Public Safety Facilities and Equipment Loan Project”. In 2017, TCB was the first bank to provide a one-stop service by adopting a trust mechanism for caregiving institutes and elderly care services. The integrated financial service which has incorporated lease right trust, real estate trust, construction fund trust, advance payment trust, and elderly trust, is set to assist small-and-medium caregiving business operators in developing, constructing, and operating caregiving facilities.

204 units of loans were taken out from TCB by the biotechnology and pharmaceutical industries or long-term care industries in 2021. By the end of 2021, the loan balance of long-term care institutions was NT$573 million.