Sustainable Development

Risk Management and Audit System

In order to better risk management through the effective implementation of internal audit, TCFHC has formulated the “Principles of Audit” and follows the “Implementation Rules of Internal Audit and Internal Control System of Financial Holding Companies and Banking Industries” to formulate the “Risk Management Policy and Guidelines” as a basis for risk management.

TCFHC and major subsidiaries are equipped with “Risk Management Committees” that are responsible for designing risk management systems, policies, and indicators for monitoring and for carrying out risk management activities. The purpose is to ensure healthy development of the Group, ensure capital adequacy, and achieve reasonable risk and return targets.

TCFHC and major subsidiaries are equipped with “Risk Management Committees” that are responsible for designing risk management systems, policies, and indicators for monitoring and for carrying out risk management activities. The purpose is to ensure healthy development of the Group, ensure capital adequacy, and achieve reasonable risk and return targets.

Risk Management Strategy and Structure

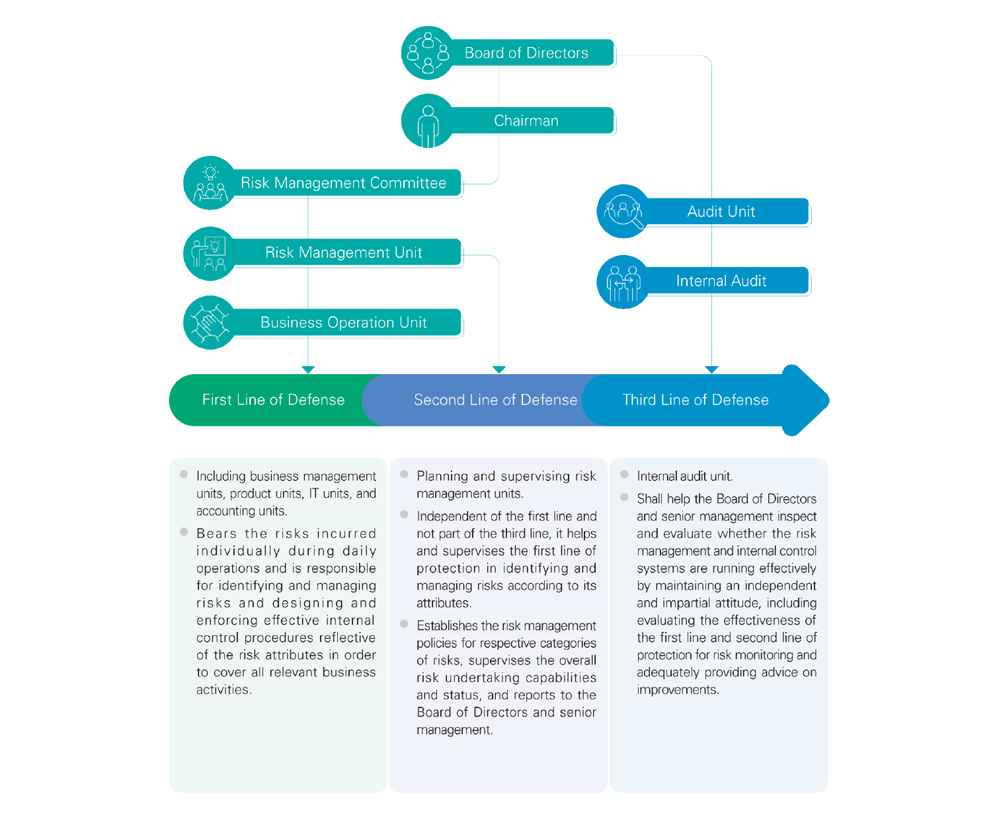

The Board of Directors is the highest governing body and the ultimate decision-maker in the Group's risk management framework, and the “Risk Management Committee” is composed of the Chairman, President, Executive Vice Presidents, Department Heads, and Presidents of all subsidiaries. The Company has also planned and constructed a risk management organizational structure to link the risk management units (second line of defense) and business units (first line of defense) of the Company and subsidiaries according to the three lines of protection in the internal control system.

The aforesaid Risk Management Committee meets on a quarterly basis. TCFHC and its subsidiaries present reports for the current period on overview of risk management, changes in capital adequacy, response to major irregularities, exposure analysis of key monitored subjects and industries, and progress followup on actions to be taken as decided in meeting minutes. Review results will be submitted to the Board of Directors.

The aforesaid Risk Management Committee meets on a quarterly basis. TCFHC and its subsidiaries present reports for the current period on overview of risk management, changes in capital adequacy, response to major irregularities, exposure analysis of key monitored subjects and industries, and progress followup on actions to be taken as decided in meeting minutes. Review results will be submitted to the Board of Directors.

Major Risk and Emerging Risk Management

Major Risks

The major risks that the TCFHC Group has been monitoring include credit risk, market risk, operational risk, and liquidity risk, which are managed by looking into authorization mechanism, limit management, indicator monitoring, and risk report. In addition, the subsidiaries are required to establish risk indicators and control procedures based on nature of product, size of business, and risk attributes. The Group had a capital adequacy ratio of 124.72% at the end of December 2021, which was consistent with the Board approved target (110.25%).

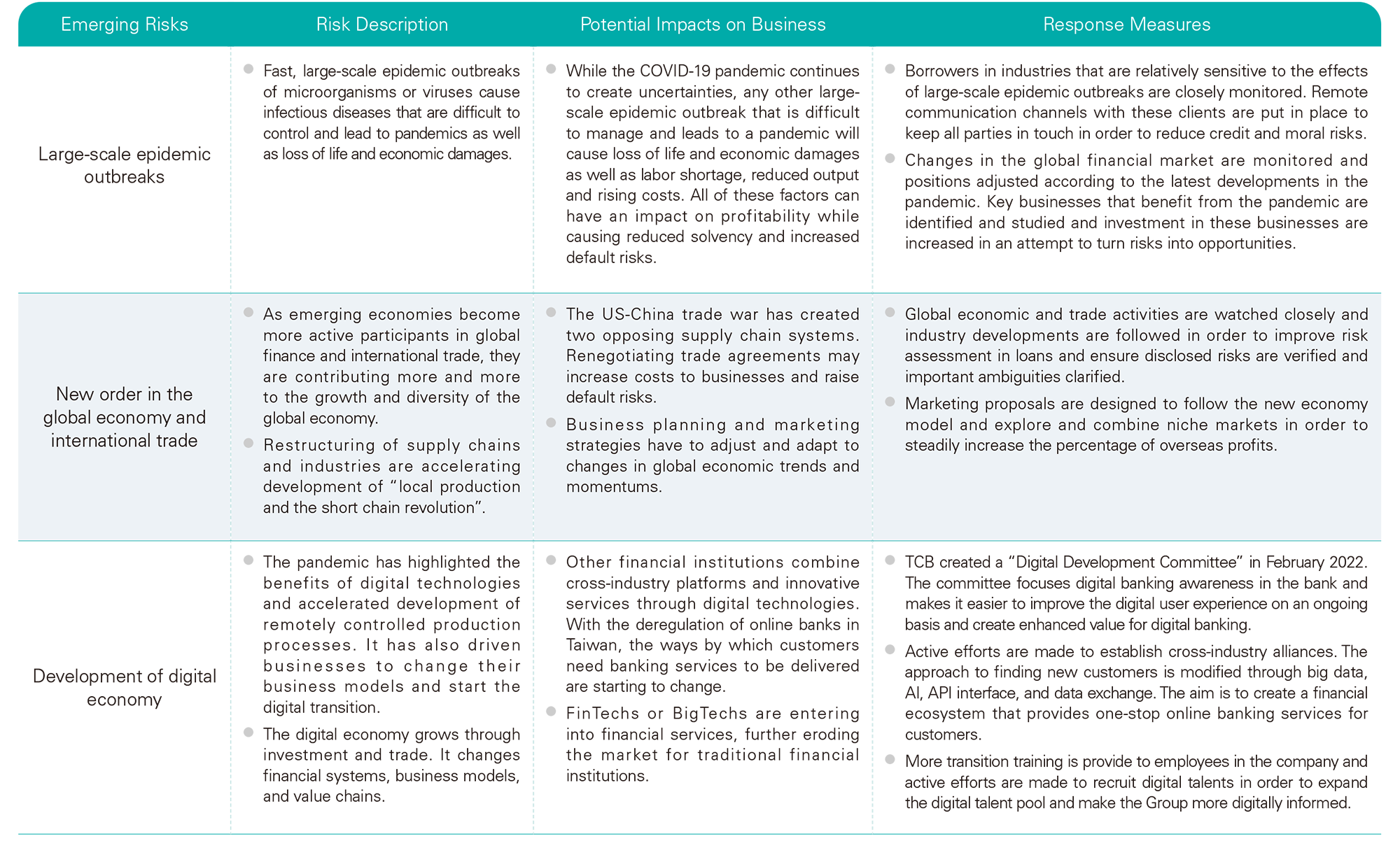

Emerging Risks

Response to Emergencies

TCFHC has the “Regulations Governing Emergency and Crisis Management” in place to activate the group-wide emergency reporting and communication system in the event of a manmade or natural disaster, faulty internal control, employee fraud, security maintenance, significant financial loss in business, or negative media coverage that can affect the company's reputation and normal operation. The crisis management task force is also in place to be in charge of handling emergencies, giving instructions and speak on behalf of the Company to outsiders according to the guidelines for spokespersons as needed.

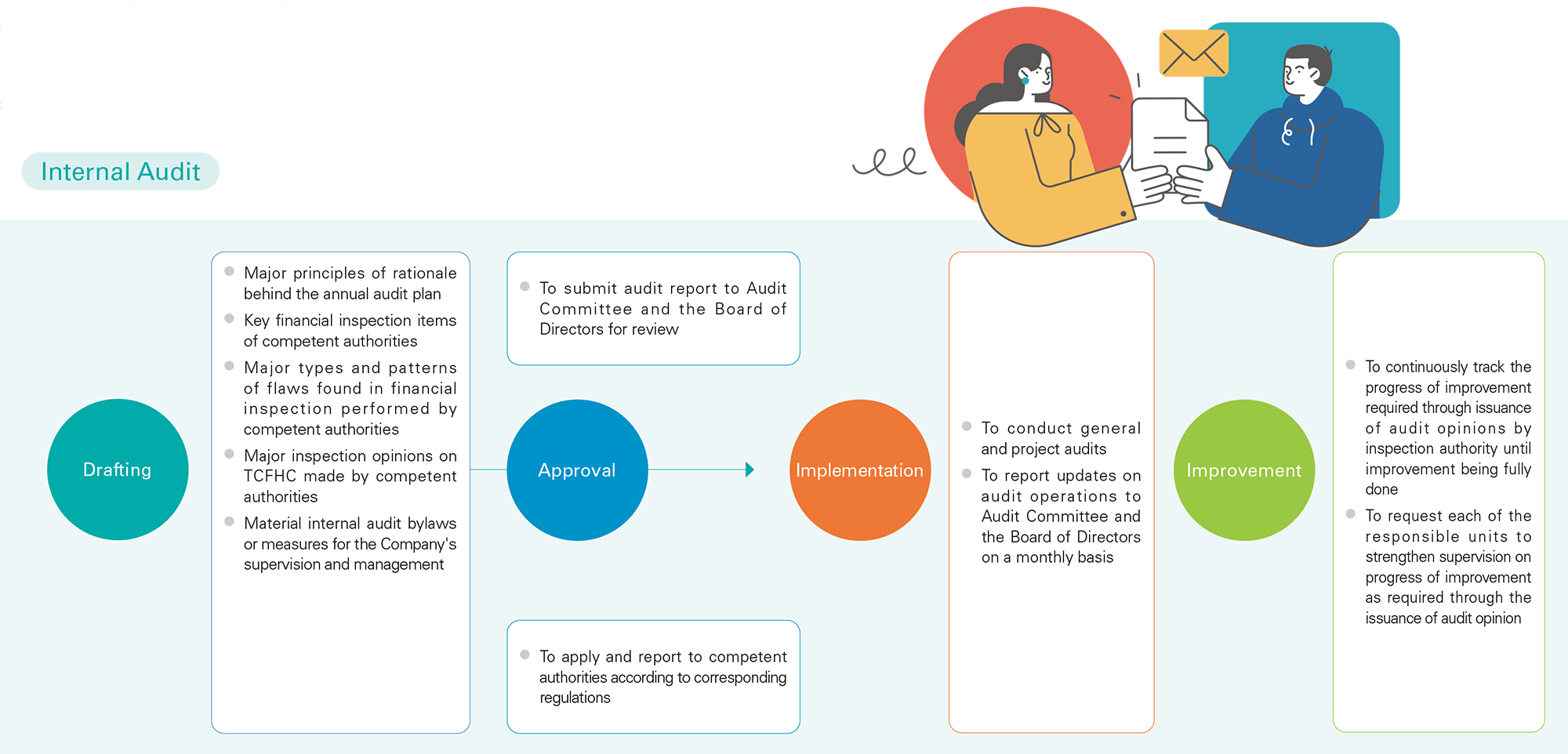

Organization and Functioning of Internal Audit

TCFHC has formulated the “Principles of Audit” and established a general auditor system to oversee overall audit operations based on the FSC “Implementation Rules of Internal Audit and Internal Control System of Financial Holding Companies and Banking Industries”. In addition, the Auditing Department reports to the Board of Directors and performs audits in an impartial manner. It assists the Board of Directors and the management in inspecting and evaluating if internal control system operates effectively and provides timely improvement advice, so as to both ensure internal control system can be effectively operated and make it as the reference for further review and revision. Internal audit units continue to follow up on review opinions of or deficiencies identified by financial examination agencies, accountants, internal audit units and internal units as well as improvements listed in internal control statements. Improvements are submitted in writing to the Board of Directors and the Audit Committee and used as an important item for penalties and rewards and performance evaluations of related units.

In 2021, the Audit Department of TCFHC Board of Directors had not just accomplished all the tasks scheduled to complete in the year, but also made a list to track improvement status as being required by each unit of TCFHC and each subsidiary, so as to prompt the gains on overall operational and risk management of the Group.

In 2021, the Audit Department of TCFHC Board of Directors had not just accomplished all the tasks scheduled to complete in the year, but also made a list to track improvement status as being required by each unit of TCFHC and each subsidiary, so as to prompt the gains on overall operational and risk management of the Group.